XRP Price Prediction: Technical and Fundamental Analysis Points to Potential Rally Toward $4

#XRP

- XRP is trading below its 20-day moving average but shows strong bullish MACD momentum

- Institutional adoption is accelerating with key partnerships and regulatory clarity

- Technical patterns suggest potential breakout toward $3.20-$4.03 resistance levels

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

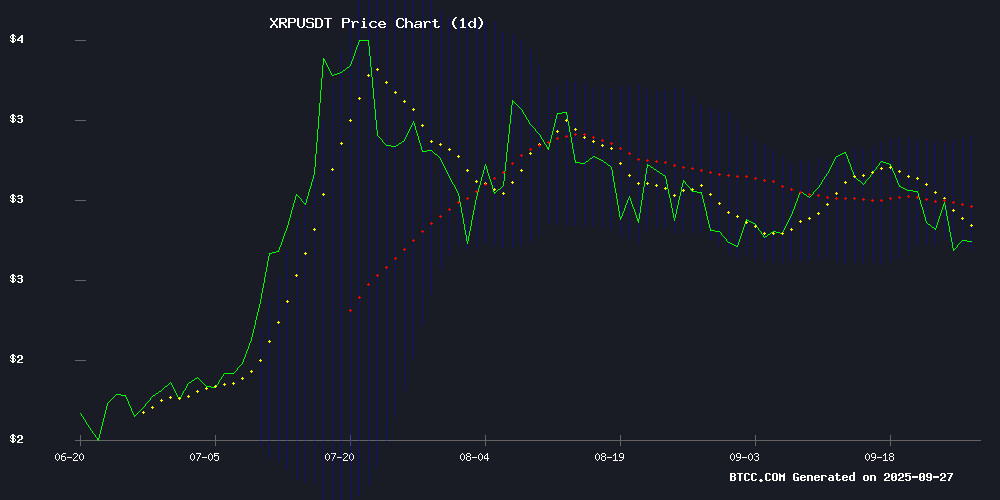

XRP is currently trading at $2.7763, below its 20-day moving average of $2.9613, indicating potential short-term resistance. The MACD shows bullish momentum with a positive histogram of 0.0851, suggesting upward pressure. Bollinger Bands place immediate support at $2.7432 and resistance at $3.1795. According to BTCC financial analyst John, 'The technical setup shows XRP is consolidating NEAR key support levels, with the MACD crossover indicating building bullish momentum that could challenge the $3 psychological barrier.'

XRP Market Sentiment: Institutional Adoption Fuels Optimism

Recent developments including Ripple's partnership with Ondo for tokenized U.S. Treasuries and FXRP's successful DeFi debut on Flare Networks have strengthened institutional confidence. BTCC financial analyst John notes, 'The SEC clarity and growing institutional adoption are creating fundamental tailwinds that complement the technical bullish signals. The $2.85 support level remains critical for maintaining the upward trajectory toward $3.20.'

Factors Influencing XRP's Price

XRP Institutional Adoption Gains Momentum After SEC Clarity

The U.S. cryptocurrency market is undergoing a significant transformation under the Trump administration, with policies emphasizing innovation, regulatory clarity, and global competitiveness. The administration's goal is to establish the United States as a leading hub for digital assets, creating a favorable environment for tokens like XRP.

This shift marks a departure from previous enforcement-heavy approaches. The new framework encourages market participation and innovation, reflecting a more pro-crypto regulatory stance.

The resolution of the SEC vs. Ripple lawsuit in August 2025, where both parties dropped their appeals, affirmed a 2023 court ruling that XRP is not a security in secondary markets. This legal clarity has removed a major barrier to institutional adoption.

Financial institutions are now integrating XRP into their portfolios without fear of legal repercussions. Bitget data shows increased accumulation by major firms, leveraging XRP's utility in cross-border payments.

XRP Bullish Trends Emerge as Ripple’s SEC Case Progresses

XRP, the digital asset tied to Ripple, is gaining traction among traders as technical indicators hint at an impending upward move. Market watchers cite on-chain metrics and shifting investor sentiment as signs of cautious optimism. Reduced selling pressure from large holders and stable market capitalization suggest a potential momentum shift.

The ongoing SEC lawsuit against Ripple remains a critical factor. A favorable ruling could spur institutional adoption, while an adverse decision may prolong uncertainty. Legal analysts anticipate the final verdict by late 2025, positioning it as a key market catalyst.

Technically, XRP has breached crucial moving averages, signaling possible bullish momentum. Traders are eyeing resistance levels that could determine the next price trajectory.

XRP Price Prediction: Coiling Spring Pattern Signals Potential Rally to $4.03 Amid Market Volatility

XRP's price action reveals a compelling technical setup despite recent bearish pressure. The digital asset currently trades near $2.76, reflecting a 0.8% daily decline, while trading volume surged 31% to $8.8 billion—indicating strong investor repositioning.

Technical analysts highlight a 'coiling spring' formation, a pattern historically associated with 30-50% price surges within weeks. This compression pattern suggests potential upside toward $4.03 once current support tests conclude. The token's failure to hold above $3 has erased $18 billion in market capitalization, yet the structural setup implies accumulating bullish energy.

Market-wide caution persists amid macroeconomic uncertainties, including potential tariff developments. The coming weeks will test whether XRP's technical promise can overcome broader headwinds.

SitonMining Introduces 'Mining + Income' Model for XRP Holders

SitonMining has unveiled an innovative approach to help XRP holders navigate market volatility by combining XRP with mining machines. This 'mining + income' model transforms XRP from a payment tool into a passive income asset, offering holders a way to achieve more stable appreciation.

The model leverages XRP-driven mining machines to expand the cryptocurrency's utility, enhancing liquidity, trading activity, and ecosystem engagement. SitonMining positions itself as a next-generation solution for XRP investors seeking to mitigate price fluctuations while earning consistent returns.

XRP's price swings have been particularly pronounced in recent market turbulence, despite its strong foothold in the payment sector. The new mining model aims to address holder concerns by creating a sustainable value-added mechanism for the digital asset.

XRP Price Prediction Models Overlook Tundra's Dual-Token Innovation

XRP's price trajectory has been a focal point for analysts since regulatory clarity emerged earlier this year. Consensus estimates, including Finder's panel projection of $3.50 by 2025, emphasize institutional adoption as a key driver. These linear models ignore ecosystem developments that could fundamentally reshape utility.

Enter XRP Tundra—a presale initiative introducing staking mechanics and twin-token economics. Traditional forecasts treat XRP as a monolithic settlement asset, blind to layered opportunities like governance rights and yield generation. Tundra's architecture represents a paradigm shift: value accrual no longer hinges solely on transactional demand.

The oversight stems from methodological constraints. Most models rely on historical price action and market cap comparables, failing to quantify ecosystem expansion. Projects like Tundra demonstrate how secondary tokenomics can create parallel value streams while maintaining XRPL compatibility—a dimension absent from current valuations.

Ripple Partners with Ondo to Bring Tokenized U.S. Treasuries to XRP Ledger

Ripple has teamed up with Ondo Finance to introduce tokenized U.S. Treasuries (OUSG) on the XRP Ledger (XRPL), marking a significant step in the convergence of traditional finance and decentralized ecosystems. The collaboration leverages Ripple's upcoming stablecoin, RLUSD, to facilitate 24/7 minting and redemption of OUSG, targeting institutional investors classified as "Qualified Purchasers."

The move challenges Ethereum's dominance in real-world asset (RWA) tokenization while raising questions about decentralized finance's ethos when access remains restricted. Liquidity seeding by both firms aims to bootstrap trading activity, positioning XRPL as more than just a payments rail.

Meanwhile, Ondo's OUSG product brings short-term U.S. government debt exposure on-chain—a foundational asset class now entering the digital realm. This institutional pivot contrasts with parallel developments in retail-focused DeFi projects, highlighting blockchain's bifurcated evolution.

XRP Tests Key Support at $2.85 Amid Struggle to Hold Above $3

XRP's recovery momentum falters as the digital asset faces persistent resistance near the $3 threshold. Trading around $2.90, the token clings to crucial support at $2.85—a level coinciding with its 100-hour moving average. Market participants watch this technical confluence closely, as a breakdown could signal renewed downside pressure.

The asset's rebound from last week's $2.68 low showed promise, clearing the 50% Fibonacci retracement of its recent $3.14-to-$2.68 decline. Yet the $2.95-$3.00 zone continues to cap advances, with profit-taking and bearish positioning creating a supply wall. A decisive close above $3.05 could open the path toward retesting yearly highs near $3.13.

XRP Price Analysis Suggests Impending Rebound Amid Market Volatility

XRP's price action reveals compelling technical patterns signaling a potential fourth-quarter resurgence. The cryptocurrency has retreated to a critical support level at $2.70, marking a 26% decline from September highs, yet chart formations suggest this may represent a buying opportunity rather than sustained weakness.

The daily chart displays a textbook Elliott Wave progression, with the current corrective phase (Wave 2) retracing between 50-61.8% of June's initial bullish impulse. Historical patterns indicate Wave 3—typically the most dynamic upward phase—often follows such consolidations. This technical narrative gains credence from concurrent formations including a double-bottom pattern with a $3.20 neckline and a descending channel that completes a bullish flag configuration.

Market structure mirrors the 2021 recovery trajectory, when XRP rallied 700% following similar technical developments. The pending approval of spot XRP ETFs looms as a fundamental catalyst that could amplify these technical signals, potentially driving institutional demand into year-end.

FXRP Launch on Flare Networks Marks XRP's DeFi Debut with 5M Token Sellout

Ripple's XRP has entered the decentralized finance (DeFi) arena through the launch of FXRP on Flare Networks. The inaugural tranche of 5 million tokens was fully minted within four hours, signaling strong demand for XRP's wrapped representation. This development unlocks yield farming, liquidity pools, and staking opportunities for XRP holders through Flare's audited trustless bridge system.

Analysts describe the milestone as the dawn of 'XRPFi' – a long-awaited DeFi ecosystem for the $176 billion market cap asset. The infrastructure supports advanced financial instruments including liquid staking derivatives and XRP-backed stablecoins, moving beyond basic token wrapping functionality.

XRP Market Shows Uncertainty but Bullish Sentiment Builds Toward $3.20

XRP faces a pivotal moment as whale activity and technical indicators paint a mixed picture. The token's 3.03% decline to $2.76 accompanies $71.8 million in whale transfers from Kraken—a move often preceding significant price action.

Analysts debate whether cooling momentum signals a temporary pause or deeper correction. With RSI and MACD diverging, the path forward hinges on whether bulls can defend key support or bears force a retracement toward lower levels.

The $12.19 billion trading volume suggests heightened speculation, particularly as observers note potential for either a rally toward $3.20 resistance or a sharp decline. Market participants await clearer signals from both on-chain activity and price action.

XRP Price Prediction: Falling Wedge Pattern Suggests Potential Breakout to $2.95

XRP is currently trading near $2.75 on Bitstamp, exhibiting a falling wedge pattern with converging trendlines between $2.60 and $2.70. Analyst @Steph_iscrypto highlights the pattern's historical reliability, citing a 70% success rate in predicting trend reversals. The consolidation phase follows a sharp rally earlier this year, drawing significant trader attention.

A breakout above the $2.90–$3.00 resistance zone could propel XRP toward initial targets of $3.20 and $3.60, with a potential measured move reaching $4.00–$4.10. Support levels at $2.70 and $2.50–$2.60 remain critical; a close below this range would invalidate the bullish setup.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case. The cryptocurrency is showing strong bullish signals with institutional adoption accelerating following regulatory clarity.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $2.7763 | Below MA but showing strength |

| 20-day MA | $2.9613 | Potential resistance level |

| MACD Histogram | +0.0851 | Bullish momentum |

| Bollinger Support | $2.7432 | Key downside protection |

| Price Target | $3.20-$4.03 | Technical pattern projection |

BTCC financial analyst John emphasizes that 'the combination of technical breakout patterns and fundamental developments creates a favorable risk-reward scenario for medium-term investors.'